Ben Bernanke's recent post "

Germany's Trade Surplus is a Problem" got me thinking about "global imbalances" again. I'm still not sure what to make of the issue. May as well think out loud.

The word "global imbalance" sounds ominous. What does it refer to? Let's start by thinking "locally," as in an economy consisting of you and me. Suppose we both work producing a good that each of us desire. From my perspective, any goods you ship to me are "imports." From your perspective, the goods shipped to me constitute "exports." If you export more than you import--so that your net exports are positive--you are running a trade surplus and I am running a corresponding trade deficit. This is the definition of "imbalanced" trade.

There is the question of how goods are paid for and how any imbalance is financed. Suppose we live in a common currency area. One possibility is that is that we pay for our shipments fully with money. At the end of the day, your trade surplus implies that you acquired more money from me than I acquired from you. Putting things this way leads us to question the notion of "imbalanced" trade. Sure, I acquired more goods from you--but you acquired more money from me in exchange. It all balances out, doesn't it?

Yes, it does. But it's still true that you exported more goods than you imported. And that extra money you acquired...what do you plan to do with it? Sit on it forever? (Actually, I explore this possibility

here.) More likely than not, you are planning to spend it one day. When that day comes, I will be induced to sell you more goods than I buy from you. It will then be my turn to run a trade surplus--an act that renders trade "balanced" in the long-run.

Nothing fundamental changes in the story above if my trade deficit is instead financed by me paying you with a private or government debt instrument, or by me issuing you a personal IOU.

But what if the pattern of trade just described persists? What if you just keep sending me more goods than I send you? Then you are running a persistent trade surplus and I am running a persistent trade deficit. You are acquiring more money and securities, while I am depleting my money and possibly issuing debt.

Well, that's right...but so what? Maybe I am young and you are middle-aged: my growth prospects look great and yours appear diminished. I am a vibrant emerging economy and you are an advanced mature economy. Maybe it makes sense for the mature slow-growing economy to lend goods (especially capital goods) to the fast-growing economy. Indeed,

Kollman et. al. (2015, pg. 53) estimate that strong growth from emerging economies contributed significantly to the German trade surplus, especially in the 2001-08 period. (Labor market reforms and an increased private saving rate are estimated to have had a larger impact since 2008.)

If we abstract from credit risk--the possibility that I or some other emerging economy may falter in some manner and fail to repay, then a persistent trade imbalance looks like an all-around good thing--something to be welcomed, not discouraged. And even if debtors do fail to repay, so what? Creditors presumably enter into lending arrangements knowing there is a risk of default. (Things become more complicated when we add elements like governments prone to bail out creditors, and creditors that become overzealous in their desire to make collections. But I'll leave this story for another day.)

So what is the problem with Germany's trade surplus? Let's say you're Germany and I'm a country in the periphery--e.g., one of the so-called

PIGS. Both you and I are wobbled by the 2008 financial crisis, but me (a debtor) relatively more so than you (a creditor). Suppose, for example, my growth prospects are suddenly diminished--I'm looking more like the mature slower-growth you lately.

Since our growth prospects are now more aligned, there's not much of a rationale for you to run trade surpluses and for me to run trade deficits--at least, not with each other. What this means is that you should no longer work so hard to make goods for my market. And because I now borrow fewer goods from you, I'll have to work a little harder myself to make up the difference. Except that you go and spoil everything by wanting to remain super busy. So you continue to work hard to export goods to me. And because my market is flooded with your goods, there is no real opportunity (or maybe even desire) for me to work harder--it's tough to compete with you. Your trade surplus translates into a lack of demand in the periphery. Why don't you use your surplus to build yourself a bridge, or something? That'll be good for you and it'll be good for me.

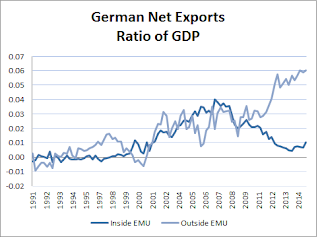

That's the Bernanke point of view in a nutshell. I don't think it's entirely wrong, but I do have a problem with the story. Recall where I wrote "there's not much of a rationale for you to run trade surpluses and for me to run trade deficits, at least not with each other?" Well, that's pretty much what happened--with some delay and to an approximation--between Germany and the rest of the EMU. That is, while Germany continued to run trade surpluses in the post 2008 period, these surpluses were not made at the "expense" of other EMU countries--see the following figure.

Germany's trade surplus is presently around 200B EUR. But its trade surplus with the rest of the EMU is only 30B EUR, which is only about 1% of German GDP. This is down from a peak of about 100B EUR in 2007. Here's another way of looking at it:

So given that Germany's trade surplus with the rest of the EMU is greatly diminished, maybe it's not the problem Bernanke thinks it is. (Whether the earlier surpluses are presently a problem is a different matter of course.)

I'm more inclined these days not to view trade imbalances as intrinsically desirable or undesirable in of themselves. If they are associated with a problem, I think they're more likely symptomatic than causal. To me, it makes sense that a mature economy like Germany should help finance growth in emerging economies. And should economic weakness in the periphery lead to trade becoming more balanced, this is no reason to cheer. After all, balanced trade is also an outcome associated with financial autarky.

Adopting this view does not preclude recommending some of the policies that Bernanke advocates. If the present low yields on safe assets like U.S. treasury debt and the German bund are the byproduct of malfunctioning financial markets leading to a "safe-asset shortage," then a wide class of theories suggest the potential benefits of a debt-financed expansionary fiscal policy (e.g., see

here) and not necessarily because such policies stimulate "aggregate demand" (e.g., see

here).

Whether additions to the public debt are used to finance public infrastructure spending, purchases of private securities, tax cuts, or something else, is something policymakers must weigh. But these decisions are likely not as important as just "getting the debt out there." The added supply is needed to prevent the seemingly insatiable private demand for the product from driving yields to zero (and lower). As the evidence suggests, in very low yield environments, excess demand for government debt is deflationary. And unexpectedly low inflation is not the tonic that economic theory prescribes for indebted countries struggling to recover from a severe recession.

***

PS. Bernanke also suggests Germany's trade surplus would have been lower if Germany had its own currency, which would presumably now be stronger than the euro against other currencies. But take a look at Switzerland, where the trade balance has grown in the face of a first stable, then strengthening, Swiss franc.

Should the Fed raise its policy rate this September or not? Seems like a lot of people want to know. For those not following the discussion closely, let me try to summarize what I think are the main arguments for and against a September rate increase.

Should the Fed raise its policy rate this September or not? Seems like a lot of people want to know. For those not following the discussion closely, let me try to summarize what I think are the main arguments for and against a September rate increase.